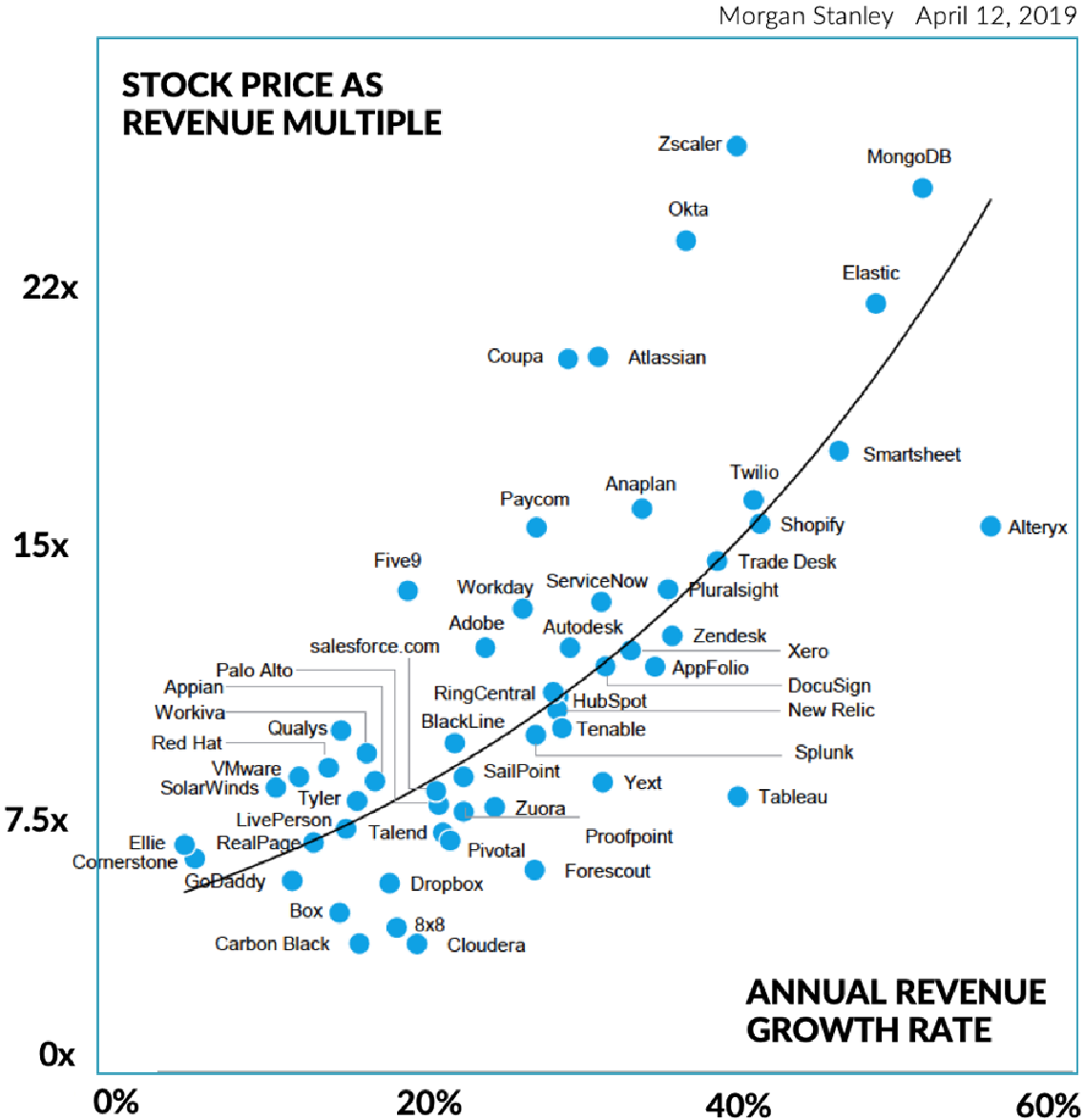

Whether you have public or private investors, your revenue growth rate drives your company’s value.

Investors reward companies that have higher growth rates over slower growing peers or investment

options. The growth rate allows them to predict your company’s future, and they include the value

of your future and its predictability in the stock price. Morgan Stanley data from April 2019 shows

the correlation of growth rate to stock price; it is the biggest driver of company value.

As an example, Workday has been growing revenue over 20% year over year and has a stock price

multiple of its revenue of 12x. Meanwhile, Cornerstone, a company in the same industry but with

a low single-digit growth rate, has a stock price multiple of revenue of just 6x. This is why CEOs,

general managers, profit and loss owners and their team members are so focused on accelerating

their growth rates.

The Compounding Effects of Smart Growth

Of course, companies shouldn’t aim for growth at all costs. Growth must be

smart and fast. A sustained, high growth rate shows both how efficiently a

company grows and how that efficiency creates a compounding advantage

over time.

In a very simplified example, take two organizations that both generate $200

million in revenue in the year. One spends $100 million to generate $200 million.

The other one spends $150 million to generate $200 million in revenue. In the

following year, the first company is able to invest an additional $100 million

($200 million total) to drive $400 million in revenue. It has generated more

capital and it uses that capital more efficiently. The second company has an

additional $50 million to invest ($150 million total) to drive just $300 million in

revenue. While oversimplified, it’s easy to see that more efficient growth allows

for faster — even accelerating — growth over time.

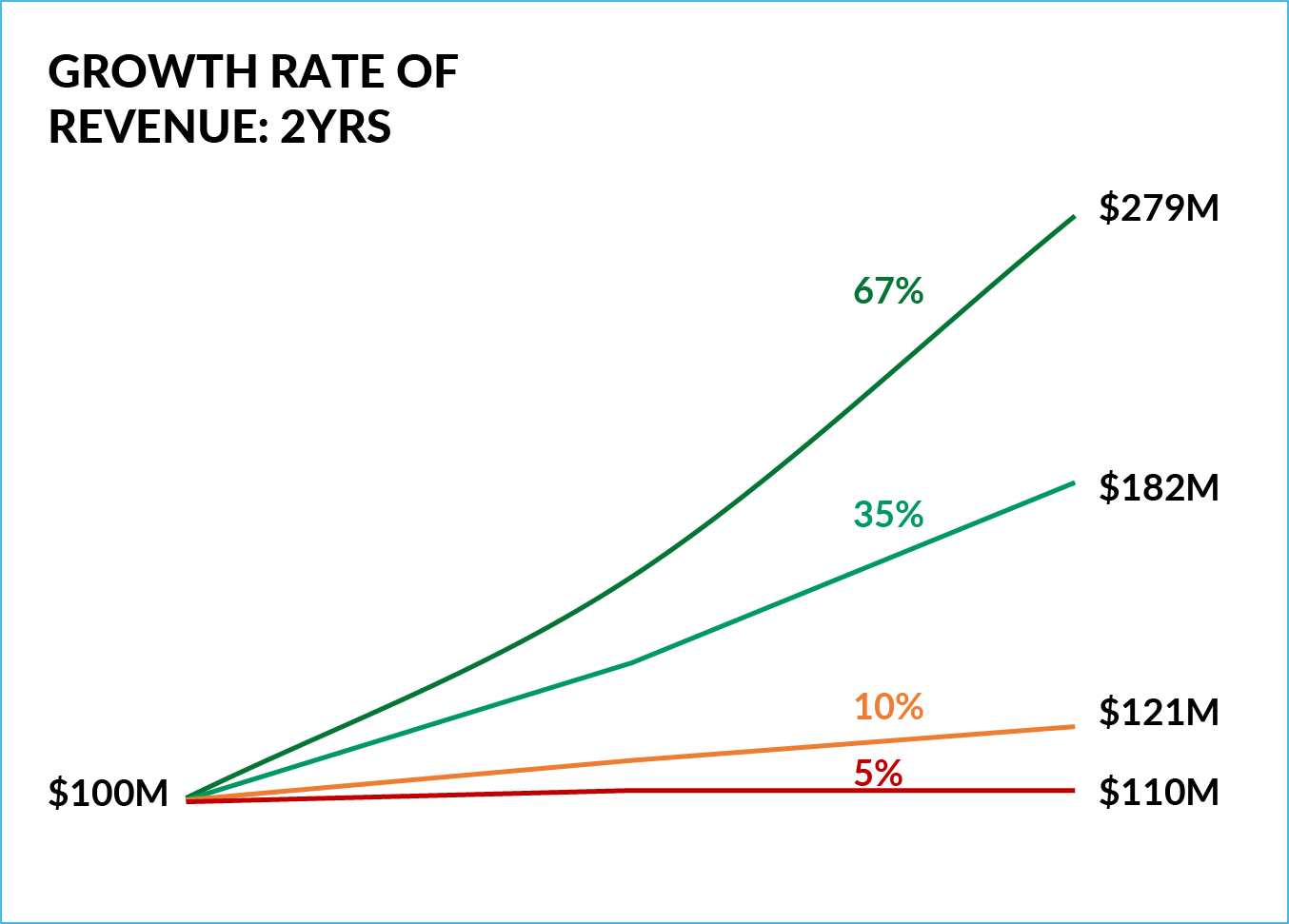

Now when we think about growth rate, we can see why smart, fast and

sustained growth is so valuable to investors. A company growing at 5% year

over year is effectively flat two years out. A company growing at 35% year over

year effectively doubles in two years.

Virtuous Cycle of Advantages

When you drive smart, fast growth for your

organization, it creates a very virtuous circle. You can invest more in creating

customer value than your slower growing competitors, and in doing so you’ll have

a more differentiated offer, so you win more customers more quickly, which in turn

feeds more growth.

This growth also helps you attract and keep talented people in your company, who

of course then accelerate your ability to innovate faster than competitors. That fast

innovation also drives faster learning so you can be more strategic. All of these

things increase company value and allow you to raise more capital to reinvest in

customer value.

Dynamic Growth Strategies

To continue to grow at a fast and smart pace in our world now, you must pay

constant attention to a much broader set of competitors and potential competitors.

Competition comes in both direct and indirect forms. In the past, competitors

provided a better product, a better price or a better way to purchase a substantially

similar product. Today, competitors may do all that or just obviate your product with

a completely disruptive alternative source of value.

In 2018 alone, $99.5 billion was invested1 in startups that might be trying to reinvent

the market you’re in. And $9.3 billion went to startups2 innovating in artificial

intelligence and machine learning, which will change just about everything we do at

work and at home.

Creating A Sustainable Growth Advantage

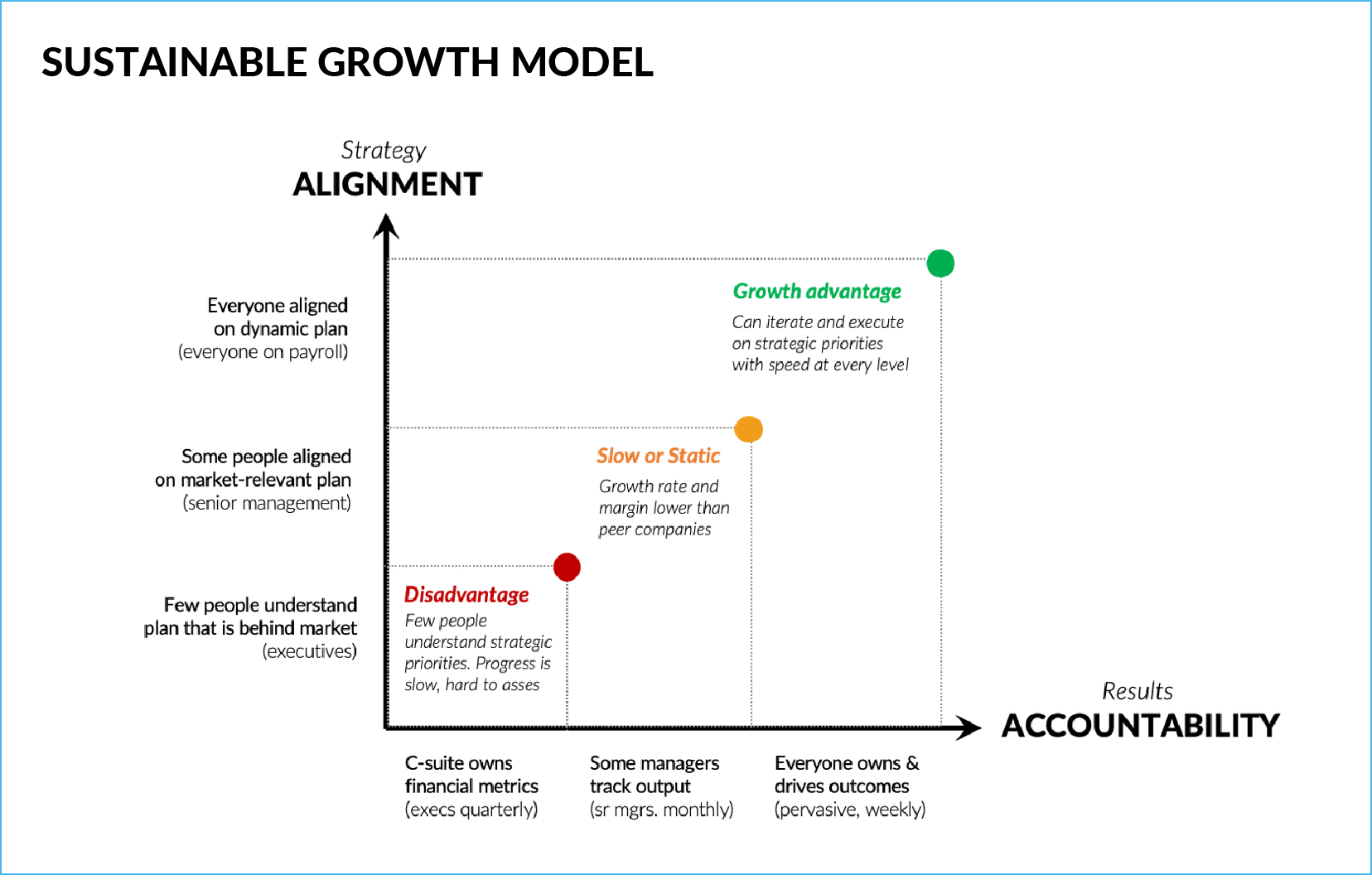

In hyperdynamic markets, the speed with which you iterate on strategic priorities,

activate them across the organization and execute them has become the most

important element for sustainable growth. How well and how fast you respond to

threats and opportunities determines how fast and how smart you grow over time.

If you’re still managing at the same pace and with the same cadence you did 5

or 10 years ago, it’s a fundamental disadvantage when faster moving companies

can alter the course of a market in just a quarter or two. Annual plans that few

people understand are too brittle and too slow today. Markets change too quickly,

and when too few people understand the strategic plan, they contribute less to

it — driving your costs up and your speed down. Slow, low alignment and slow

management measurement create extreme disadvantage in hyperdynamic

markets. If you lead slow, you can’t expect to grow fast.

High-growth organizations use a more accelerated and systematic approach

to iterating, aligning and measuring progress toward strategic priorities to be

responsive to market opportunities and more smartly tap their full execution power

to achieve those strategic priorities faster and more efficiently. Most venture-funded

companies and increasingly fast-growth public companies use OKRs and results

platforms to drive that quarterly iteration, alignment and accountability through

every team.

Organizations that can quickly identify opportunities and threats, adjust their

strategic priorities rapidly, and intelligently activate those priorities through their

organizations so everyone is aligned in the most competitive direction have a

sustainable growth advantage. Regardless of market shifts, they can rapidly tap

their full strength and scale at speed to respond and move ahead.

1 Soper, Taylor. “VC Funding in U.S. Startups Nears $100 Billion in 2018, Highest since Dot-Com Era.” GeekWire, 7 Jan.

2019, www.geekwire.com/2019/vc-funding-u-s-startups-nears-100-billion-2018-highest-since-dot-com-era/

2 Bloomberg.com, Bloomberg, www.bloomberg.com/news/articles/2019-01-08/vcs-plowed-a-record-9-3-billion-into-aistartups-

last-year.

About the author

CEO and co-founder of WorkBoard

Deidre Paknad has been CEO of

several high-growth

organizations and ran a

high-growth business at

IBM. In addition to her

primary role as CEO at

WorkBoard, she works

with senior leadership

teams to clarify, align

and measure strategic

priorities. Deidre has over

a dozen patents and has

twice been recognized

for innovation by the

Smithsonian Institute.